.gif)

.gif)

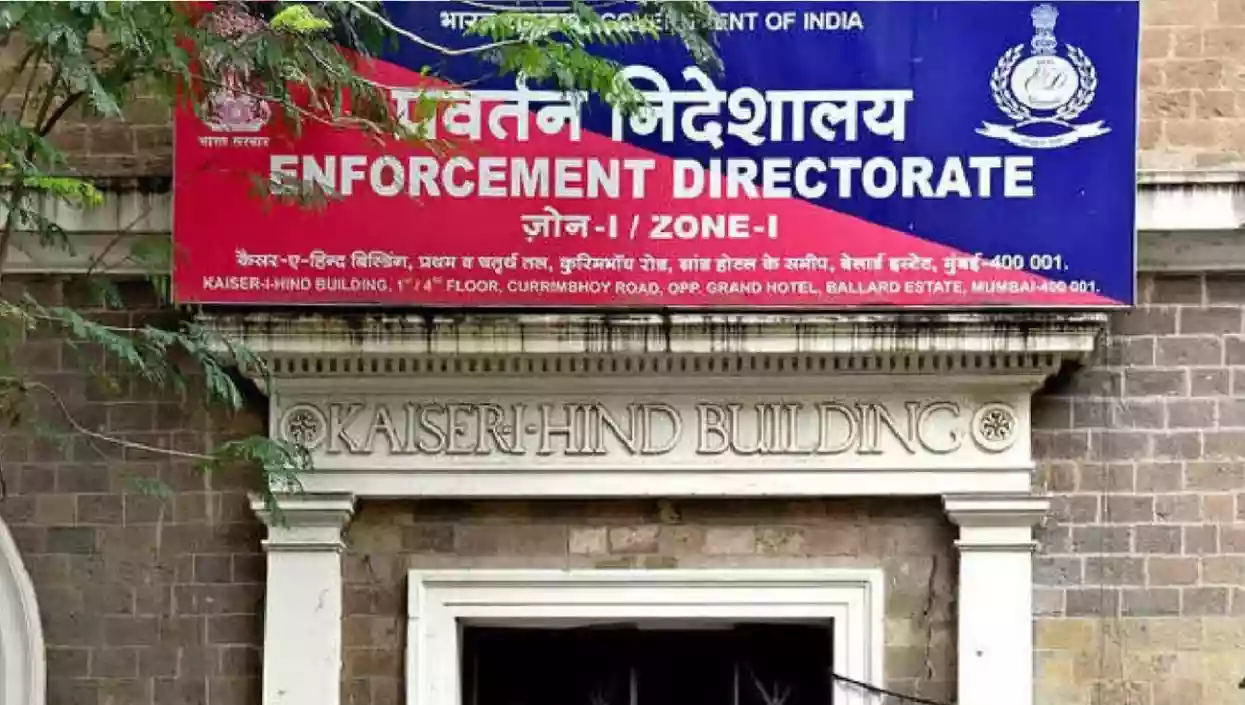

The Enforcement Directorate (ED) has initiated a high-profile crackdown on a ₹125 crore money laundering syndicate allegedly connected to hawala transactions, with raids conducted across Maharashtra and Gujarat. The raids, carried out early Thursday morning, targeted 23 locations linked to Malegaon-based trader and suspected hawala operator, Siraj Ahmed Harun Memon, accused of funneling over ₹125 crore through illicit transactions into shell companies.

The investigation centers around suspicious deposits made into the accounts of 12 unemployed youths at Malegaon Merchant Bank. These accounts were allegedly used to channel hawala funds, and the funds were possibly linked to election-related financing. The ED's actions come after reports surfaced revealing that over ₹12-15 crore was deposited in the accounts of each youth, raising concerns due to the large amount of money involved in a communally sensitive area like Malegaon.

The initial probe by Nashik Rural police uncovered significant irregularities, including 14 accounts with over 2,200 transactions amounting to ₹112 crore in credits. The investigation revealed that the accounts were misused by Memon and associates for financial transactions, raising alarms over potential misuse of funds.

The ED's investigation has expanded across 24 cities, including Malegaon, Nashik, Mumbai, Ahmedabad, and Surat. Officials have identified that ₹45 crore was transferred to shell companies in Ahmedabad, including Pragati Trader and MK Marketing, using Axis Bank accounts. The funds were funneled through these shell companies to other entities.

Authorities allege that Memon exploited vulnerable individuals from poor backgrounds, luring them with promises of jobs in Agricultural Produce Market Committees (APMCs) in exchange for their personal documents. These documents were used to open bank accounts and establish shell companies for the laundering operation.

Central agencies are also exploring the possibility of links to terror financing, given the scale of operations and the nature of the transactions involved. The ED's crackdown highlights the growing focus on dismantling hawala operations and the misuse of banking channels for illegal financial activities.